A Global Solution for Islamic Finance

New Opportunities: Diamond Standard commodities as digital titles for Tawarruq.

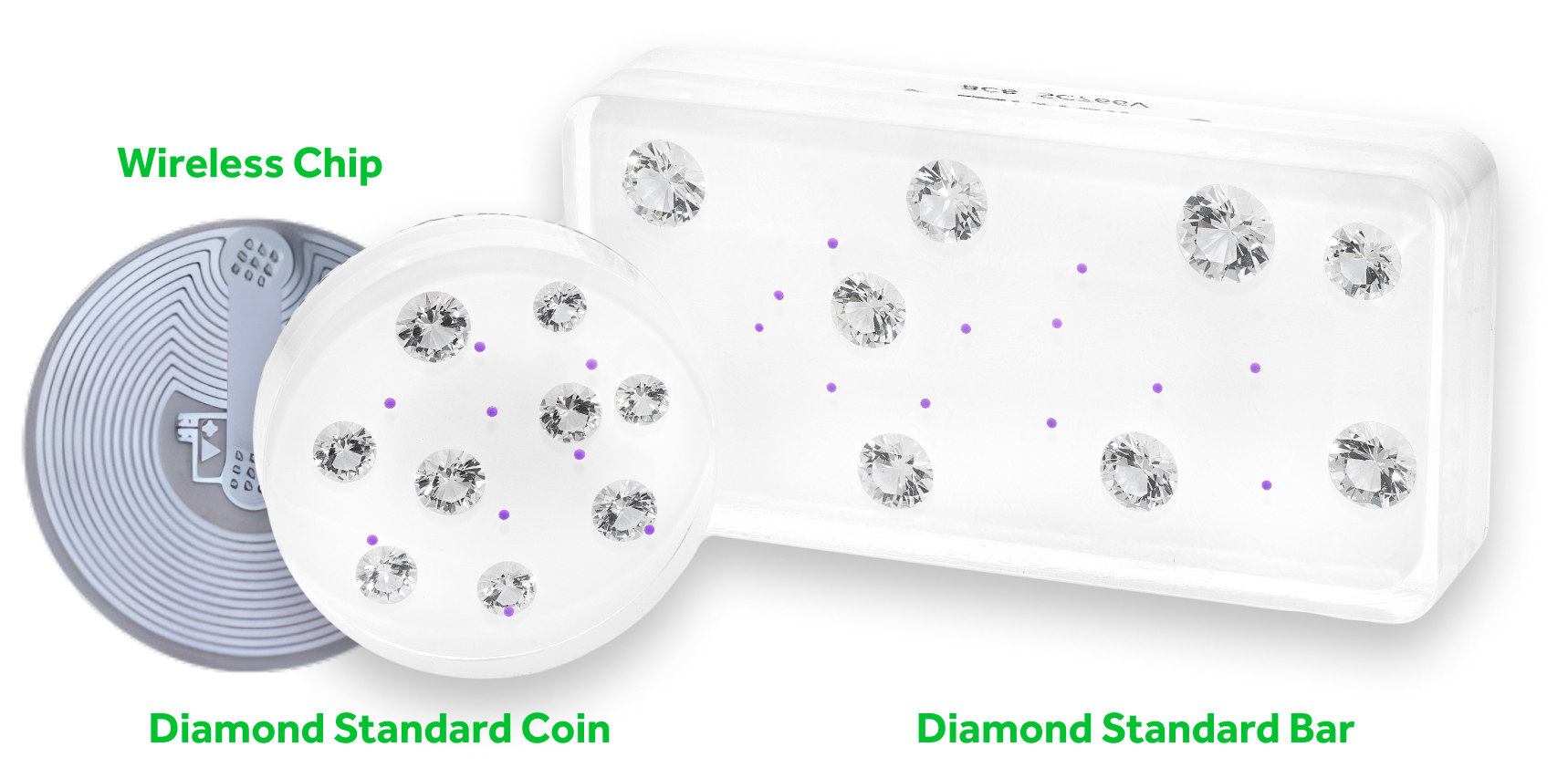

Diamond Standard Commodities

Uniquely suitable for commodity Murabaha

Real and Deliverable

Real and DeliverablePhysically stored (and digitally audited) in Dubai, ensuring immediate deliverability.

Arm's Length Trading

Arm's Length TradingLocally traded on a transparent market platform, ensuring fair pricing and Shariah compliance.

Title and Possession

Title and PossessionIntegrated wireless chip and token enables instant digital title transfers and asset redemption.

Key Benefits of Utilizing Diamonds in Commodity Murabaha

High Value Density

Small volume and high value make diamonds easy to store and transport, which can simplify logistics and reduce associated costs.

Halal Commodity

Diamonds are not considered ribawi. They are tangible commodities whose intrinsic value is derived from their physical characteristics.

Market Liquidity

Diamonds, especially those standardized by Diamond Standard, have high liquidity, facilitating easier and quicker transactions.

Diamond Standard Fatwa

Read Our Fatwa

Fatwa approved by

Sheikh Dr. Mohamed Ali Elgari

Permitted for use in Islamic Finance and Commodity Murabaha.

At Diamond Standard, we are honored to express our sincere appreciation to Sheikh Dr. Mohamed Ali Elgari, a globally recognized authority in Islamic finance, for issuing the Fatwa that affirms our diamond commodities as Shariah-compliant.

Dr. Elgari’s esteemed contributions have shaped Islamic finance standards worldwide. His roles demonstrate the depth of his expertise and the weight of his approval:

- PhD in Economics from the University of California

- Former Professor and Director of the Centre for Research in Islamic Economics at King Abdulaziz University

- Shariah board member for globally respected institutions such as BlackRock, Gulf International Bank, National Bank of Fujairah, AAOIFI, Dubai Islamic Bank, HSBC, and Dow Jones Islamic Index

This Fatwa marks a pivotal moment—not only for Diamond Standard, but for the broader $5 trillion Islamic finance market—enabling a new, ethical, and compliant solution for Murabaha and Sukuk structures.

We extend our heartfelt thanks to Dr. Elgari for his thoughtful guidance and his endorsement of our efforts to bring technological innovation and Shariah integrity together in service of global Muslim communities.

“We are deeply grateful for Dr. Elgari’s blessing and scholarly insight. His Fatwa sets the foundation for Diamond Standard to serve as a bridge between enduring Islamic values and modern commodity markets.”

-Founder & CEO, Diamond Standard

Applications for Financial Institutions

Islamic Spot Exchange

Our goal is to support a consortium of islamic banks, allowing greater efficiency, reduced transaction costs, and enhanced risk management.

This collaborative approach fosters innovation and enhances scalability, enabling access to larger markets and shared technology advancements.

Names are for illustrative purpose only.

Names are for illustrative purpose only.

Want to learn more?

Fill the form or email us, and a member of our team will get back to you as soon as possible.