Why Diamonds?

Four benefits of investing in diamond commodities

Data prior to February 2021 is back-tested.

Prices Near Historical Lows

Data prior to February 2021 is back-tested.

Since November 2023, diamond prices have started trending upward, presenting an opportunity for investors to enter the diamond market at historically attractive prices.

Financialization Effect

With the introduction of ETFs for physical gold, silver, and uranium, the accessibility of these investment products fueled investor demand, resulting in positive long-term returns. We anticipate a similar potential for the diamond commodity as new investment products are introduced.

Source: Data from estimates sourced from various industry groups and analysts.

Source: Data from estimates sourced from various industry groups and analysts.Diamonds are Underallocated

Source: Data from estimates sourced from various industry groups and analysts.

Source: Data from estimates sourced from various industry groups and analysts.Investors own 15% to 30% of the precious metals above-ground supply, but only an estimated 2% of diamonds because of previous barriers to entry.

Stability in Times of Crisis

From the 2002 Recession to the Russian Invasion, diamonds have provided a hedge in investor portfolios from adverse market events.

“Precious metals, like gold and silver, have long been used as hedges in times of inflation and market volatility. And now diamonds are performing the same role.”

Forbes Contributor, Jane Hanson (2023)Diamond Truths:

Busting Common Myths

De Beers no longer dominates the global diamond market. Starting in 2000, diamond producers from various regions began distributing diamonds independently of the De Beers channel. This shift improved market dynamics, fostering increased competition, fragmentation, transparency, and liquidity. As a result, De Beers' market share in rough diamonds has permanently declined, dropping from nearly 90% in the 1980s to approximately 29% in recent years.

Discover Diamond Insights

Explore the exciting opportunities in the diamond investment landscape through our featured blog posts:

“The integration of blockchain technology to create a new commodity asset class is something really innovative,” explains Dr. Rajib, a Professor of Finance and Accounting at Vinod Gupta School of Management

One could argue that an asset’s right of passage to the commodity world is becoming an exchange traded fund (ETF). If true, diamonds might be the next asset to become financially tradable.

Throughout history, examples arise of instances where diamonds present an excellent illustration of why investing in these tangible assets may be a ‘safe haven’ in times of economic uncertainty.

Begin Your Diamond Investment Journey

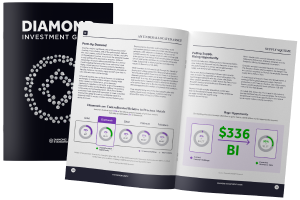

Download Our Free

Diamond Investment Guide

Understand the nuances of diamond investing, from assessing quality to tracking market trends.

Download the Guide now

Ready to Diversify Your Portfolio with Natural Diamonds?

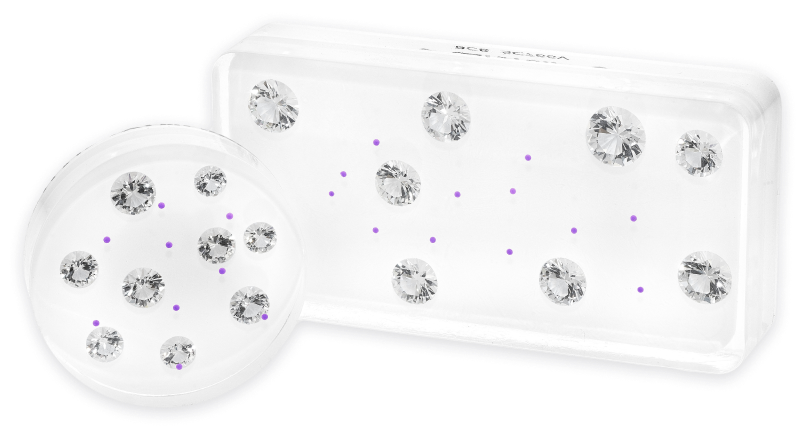

Get started with Diamond Standard today. Create your wallet and invest in natural diamonds for as low as $25.

Create an Account