The Cut

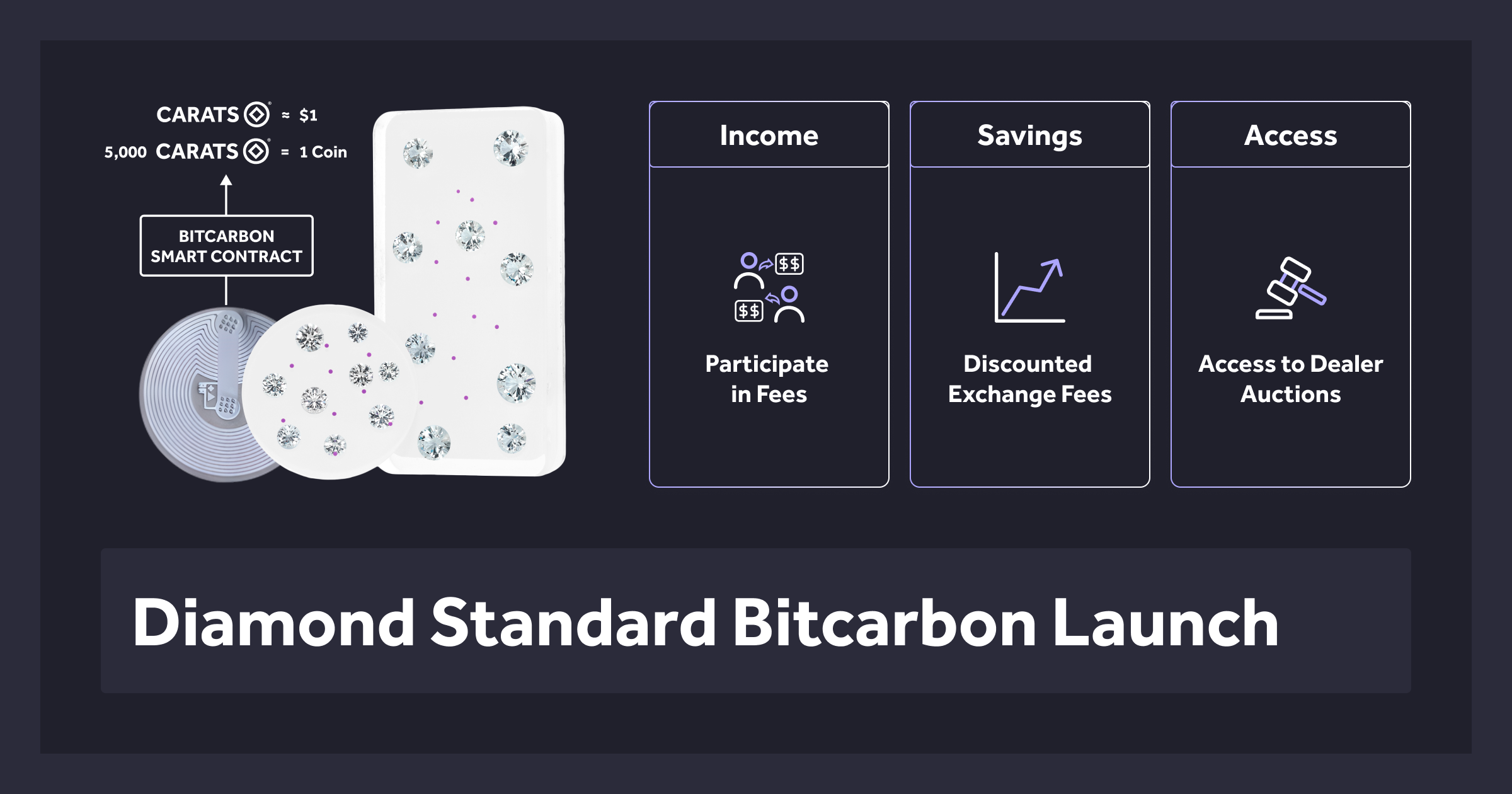

Company Announcements

Stay abreast of Diamond Standard's latest endeavors. This section offers timely announcements on product rollouts, collaborations, and pivotal updates, providing an exclusive insight into our corporate landscape and its market implications.

Education

From novices to seasoned investors, the Education section is a rich repository of articles and guides. Diamond Standard is dedicated to equipping you with the comprehensive knowledge required for astute financial decision-making.

Fintech Spotlight

Navigate the dynamic fintech landscape with our Fintech Spotlight. Explore incisive analyses on emerging companies and technologies reshaping the contours of traditional finance.

Market Perspective

Gain nuanced understanding of financial market dynamics with our Market Perspective. Featuring analytical articles on trends and forecasts, this section aids in deciphering the complexities of the current economic environment.

Smart Investing

Unlock the fundamentals and intricacies of astute investing with our Smart Investing section. Discover tailored guidance across various asset classes to help refine your investment strategy.

Sustainable Solutions

Discover how finance meets sustainability in our Sustainable Solutions section. Delve into responsible investment practices like ESG and impact investing, and understand their role in shaping a sustainable financial future.

The Cut: Industry Insights

by Diamond Standard

Diamond Standard's Blog: The Cut offers a curated reservoir of financial insights and expertise in diamond commodities and fintech. Dedicated to fostering informed decision-making, this platform is a testament to our commitment to advancing financial literacy and diverse investment strategies.

Enhance your financial acumen with Diamond Standard's Blog: The Cut. Subscribe below for a regular influx of invaluable insights.