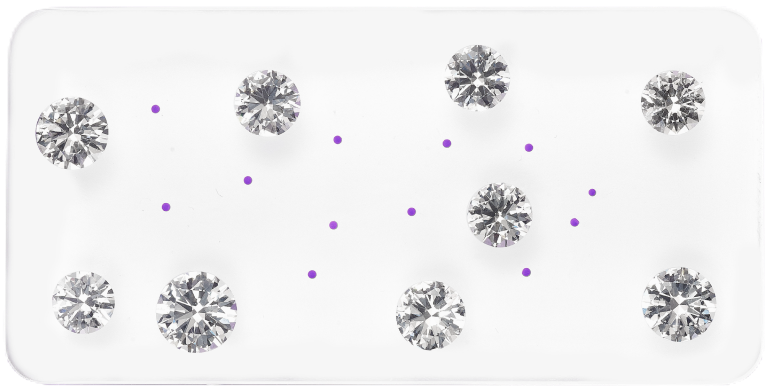

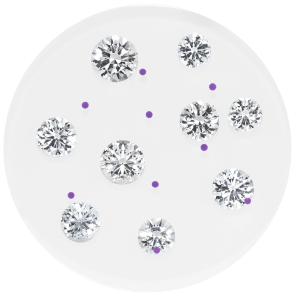

Choose your DIAMOND STANDARD CO. SMART COMMODITY™

All Coins and Bars contain a fungible set of natural diamonds and are equal based on the Diamond Standard.

$ 2,730 USD

Price Updated Daily

$ 27,300 USD

Price Updated Daily

Diamond Standard Carats

NEW

Invest in diamonds at a fraction of the cost.

Invest Brilliantly™

in 4 Easy Steps

Diamond Standard Commodities offer investment diversification for your financial portfolio

Delivery Options

Purchasing your Diamond Standard Commodity, you have 2 options for delivery: Custody Delivery or Physical Delivery

Custody Delivery: The smart commodity is stored at Brinks in a secure vault.

Tip: Over 90% of the clients choose custody delivery, for the advantages of $0 Tax and ability to transact on the spot market, plus being able to remotely audit your smart commodity. There is an annual custody fee of $36 with custody delivery.

Physical Delivery: The smart commodity is delivered via insured mail.

Physical delivery allows the ability to hold the smart commodity in your hand. However, transactions can only be done in-hand, taxes apply based on your state, and auditing can only happen in-person. There is no custody fee with physical delivery.

Commodity Features

All Coins and Bars are equivalent, containing a fungible set of natural diamonds.

Diamond Standard offerings are internally audited by Deloitte

Diamonds sourced through transparent bidding on an electronic diamond exchange

All diamonds are independently graded and/or inspected after grading by GIA & IGI

Verify the natural diamonds in your diamond commodity using our Authenticate tool

Diamond Standard Coins and Bars are assembled inside the IGI gemological labs

Diamond Standard charges no fees for any future transactions (except token enablement)

Trade Instantly

The Spot Market is a Peer-to-Peer exchange platform for current holders and future investors in Diamond Standard’s Coins and Bars. Users can view Bids and Asks from others or can set limit orders. The Spot Market provides liquidity to the world’s only fungible diamond commodity

Trade Coins and Bars via the Spot Market with ease

Buy: set a maximum price (Bid) or hit a seller’s Ask

Sell: set a minimum price (Ask) or hit a buyer’s Bid

Audit and Oversight

Deloitte is the internal auditor for Diamond Standard Ltd, read the Deloitte Audit Reports for:

Upcoming Products

Diamond Standard Futures*

on the CME Globex Exchange

To Be Regulated by U.S. CFTCHave been approved to list on the MGEX exchange via the CME Globex Platform, pending CFTC approval

Diamond Standard Options*

on the CME Globex Exchange

To Be Regulated by U.S. SECHave been approved to list on the MIAX options exchange, pending CFTC approvall

Diamond Standard ETF*

on NYSE ARCA

To Be Regulated by U.S. SECWill be listed on the NYSE ARCA exchange, pending SEC approval

* Coming soon, applications submitted and pending approvals