Week in Review: Recession Fears Weigh on Equities

US equity indexes were down on the week: S&P 500 -3.4%, NASDAQ -4.0% and DJIA 2.8% after rallying for the past two weeks. Market participants shifted their focus from the potential slowing of the pace of Fed rate hikes to concern that the US economy is heading toward a recession. Ironically, some of the strength in recent US economic indicators is prompting worries that the Fed may not be able to slow its pace of rate hikes and therefore cause a deeper economic slowdown ahead.

In a case of "good news is bad news" for equities, the US ISM Services Index beat the consensus estimate of 53.5 to come in at 56.5 for November - stronger than October's result of 54.4 and indicating that economic activity in the services sector grew for the 30th consecutive month. The November ISM Services result is in contrast to ISM Manufacturing result, released last week, which dipped below 50.0 indicating that the manufacturing sector contracted during the month. US wholesale prices cooled less than expected in November with both the headline and core PPI readings coming in above the consensus expectation at +0.3% m/m and +0.4% m/m respectively. The PPI Indexes showed no sign of price pressure relief. Finally, the University of Michigan's consumer sentiment index improved for the December preliminary read, beating the consensus estimate of 57.0 to come in at 59.1, up from 56.8 in November. Bloomberg reports that "better income prospects and lower gasoline prices likely played a role" in consumers more positive outlook.

Ahead next week: A busy week on the data front with the release of November US CPI, retail sales, and the FOMC meeting. At the time of writing, markets price the Fed Funds Rate to be 52bp higher at the 14 December meeting and to peak at 4.96% in May 2023.

Chart: S&P 500 vs US 10 yr yield (%). Rising bond yields weighed on equities. Since mid-October when the US 10 yr yield peaked, the S&P 500 has rallied over 11%. Despite that latest rally, the SPX was lower on the week, closing under its 200 day moving average (green line).

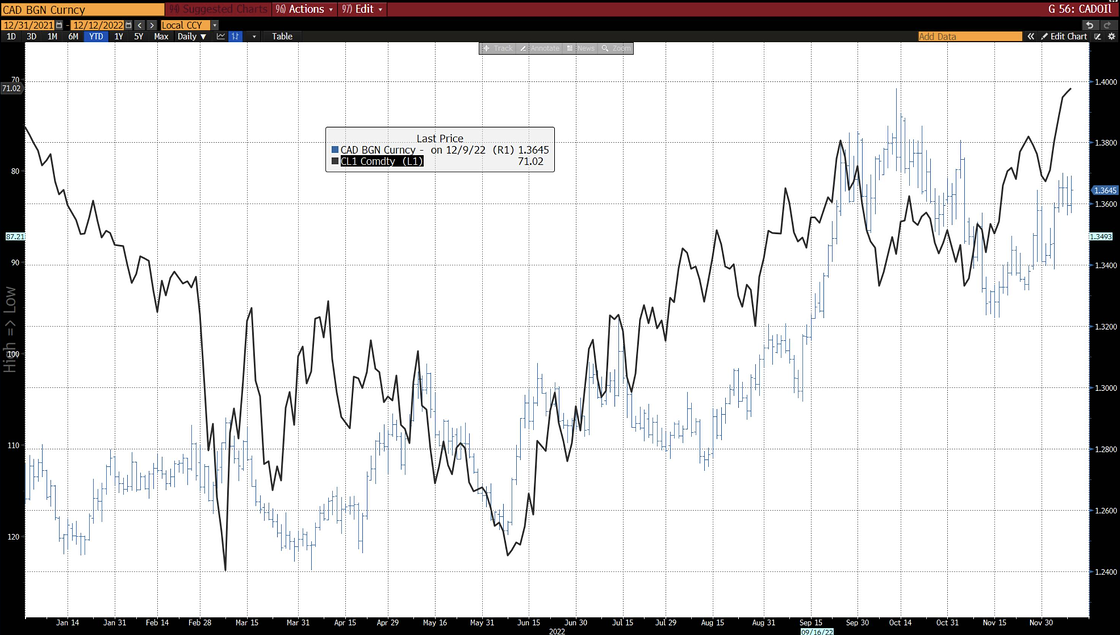

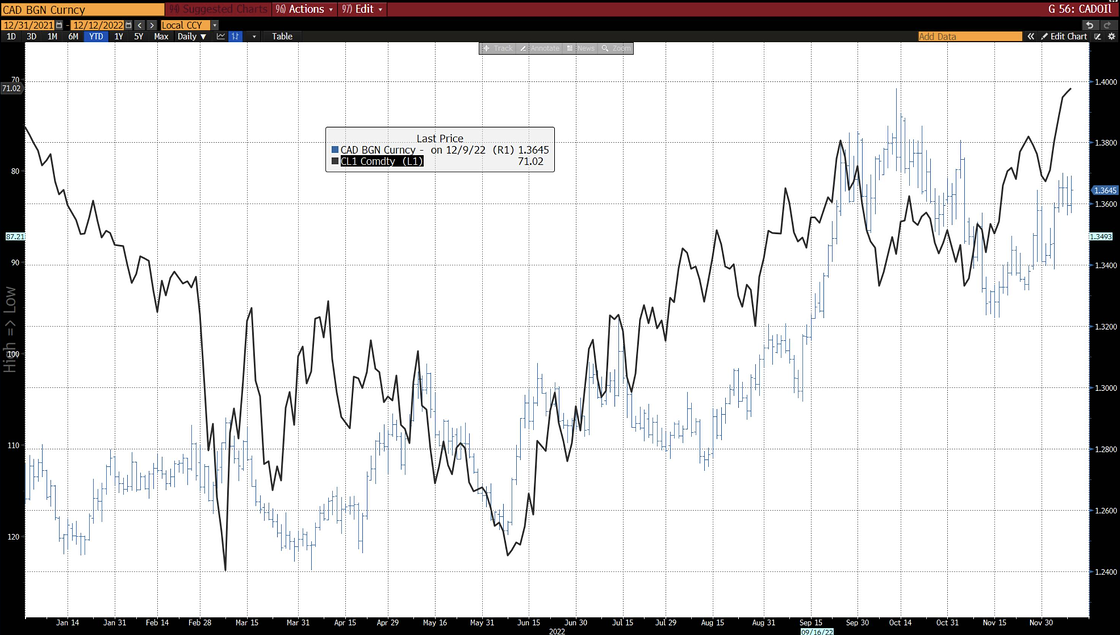

USD mixed USD, DXY Index, was mixed trading above the key 105.00 level and below, ending at 104.93 for a small gain of 0.25% on the week. Stronger than expected US economic data, discussed above, supported both the USD and the US 10 yr yield, which also ended the week a bit higher at 3.57%. CAD, JPY, and NOK faired the worst against the USD this week, while CHF, NZD, and AUD gained. EUR was relatively unchanged, ending the week above 1.0500 at 1.0540. Factors weighing on CAD included the Bank of Canada hiking 50bps, but removing reference in its forward looking language to further rate hikes being needed. In addition, lower crude oil prices weighed on CAD (chart below). Oil prices were under pressure due to market participants concern about the 2023 global economic outlook, which is expected to slow. AUD was supported on the week vs USD by the RBA's 25bp rate hike and retention of its tightening bias, which was a hawkish surprise to market participants.

Chart: USDCAD (rs, blue) vs Crude oil first future (ls, inverted, black). CL1 fell from $79.98 last Friday to $71.02 this Friday.

The Diamond Commodity

DIAMINDX was unchanged on the week, gold fell a slight 0.02%, and silver rose 1.4% on the week.

With the decline in the USD, DXY Index, which started in September, gold and silver have rallied strongly. Gold is up 10.8% from its low on September 26 and silver is up 32% from its low on September 1. Gold and silver have also benefitted from the expectation that the Fed will slow its rate hike pace, which has weighed on USD. With the Fed meeting next week, a hawkish surprise could support the USD and weigh on gold and silver.

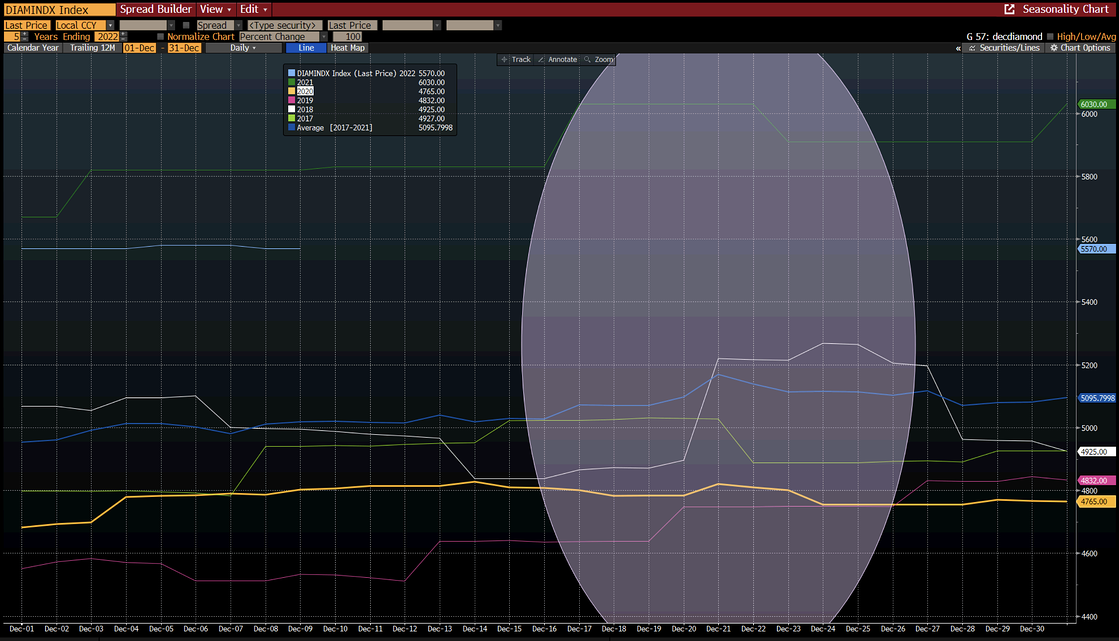

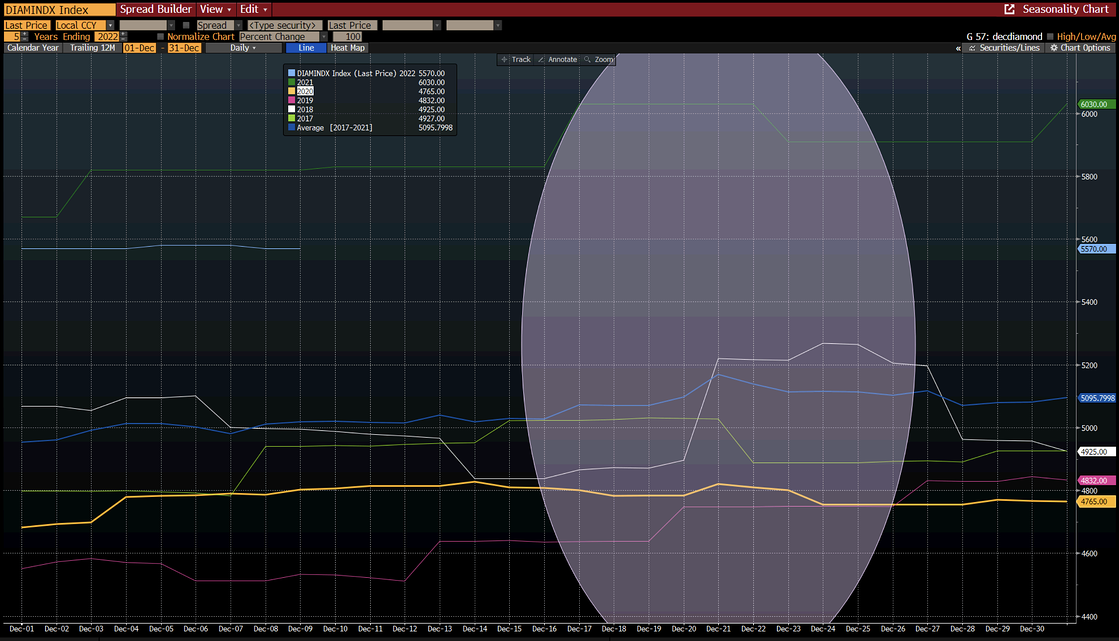

As DIAMINDX is uncorrelated, the fall in the USD has not impacted its price, which has been moving lower. DIAMINDX on average over the past five years strengthens in December. Most holiday jewelry sales are made relatively last minute and December price action for DIAMINDX reflects this (chart below). According to Rapaport, US jewelers remain optimistic "as holiday sales gain momentum."

Chart: DIAMINDX seasonality in December - last 5 years and average. Price picks up in mid-December ahead of the Christmas holiday.

The Diamond Commodity

DIAMINDX was unchanged on the week, gold fell a slight 0.02%, and silver rose 1.4% on the week.

With the decline in the USD, DXY Index, which started in September, gold and silver have rallied strongly. Gold is up 10.8% from its low on September 26 and silver is up 32% from its low on September 1. Gold and silver have also benefitted from the expectation that the Fed will slow its rate hike pace, which has weighed on USD. With the Fed meeting next week, a hawkish surprise could support the USD and weigh on gold and silver.

As DIAMINDX is uncorrelated, the fall in the USD has not impacted its price, which has been moving lower. DIAMINDX on average over the past five years strengthens in December. Most holiday jewelry sales are made relatively last minute and December price action for DIAMINDX reflects this (chart below). According to Rapaport, US jewelers remain optimistic "as holiday sales gain momentum."

Chart: DIAMINDX seasonality in December - last 5 years and average. Price picks up in mid-December ahead of the Christmas holiday.

Diamond News:

The 303.10 carat Golden Canary diamond sold at Sotheby's New York magnificent jewels auction on December 7 for USD 12.4 million. Sotheby's described this as a strong price, but the diamond missed its high estimate of USD 15million. This diamond was once known as the Incomparable Diamond and was 407 carats and was shield shaped. It was recut into a more traditional pear shape. Read this article by Rapaport "Why are Large Stones Losing their Luster at Auction?"

Debeers announced that it was extending sightholders' three-years contracts for an extra year as global uncertainties persist. Existing contracts, which determine allocations of rough, will now run until the end of 2024, instead of the end of 2023.

Diamond News:

The 303.10 carat Golden Canary diamond sold at Sotheby's New York magnificent jewels auction on December 7 for USD 12.4 million. Sotheby's described this as a strong price, but the diamond missed its high estimate of USD 15million. This diamond was once known as the Incomparable Diamond and was 407 carats and was shield shaped. It was recut into a more traditional pear shape. Read this article by Rapaport "Why are Large Stones Losing their Luster at Auction?"

Debeers announced that it was extending sightholders' three-years contracts for an extra year as global uncertainties persist. Existing contracts, which determine allocations of rough, will now run until the end of 2024, instead of the end of 2023.

Disclaimer:

This report has been prepared by the Strategy Team of Diamond Standard Inc. (“Diamond Standard”). This report, while in preparation, may have been discussed with or reviewed by persons outside of the Strategy Team, both within and outside Diamond Standard. While this report may discuss implications of legislative, regulatory and economic policy developments for industry sectors, it does not attempt to distinguish among the prospects or performance of, or provide analysis of, individual companies and does not recommend any individual security or an investment in any individual company and should not be relied upon in making investment decisions with respect to individual companies or securities.

Opinions and estimates offered constitute our judgement and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. Under no circumstances does the information contained within represent a recommendation to buy, hold or sell any security, and it should not be assumed that the transactions discussed were or will prove to be profitable.

The Diamond Commodity

DIAMINDX was unchanged on the week, gold fell a slight 0.02%, and silver rose 1.4% on the week.

With the decline in the USD, DXY Index, which started in September, gold and silver have rallied strongly. Gold is up 10.8% from its low on September 26 and silver is up 32% from its low on September 1. Gold and silver have also benefitted from the expectation that the Fed will slow its rate hike pace, which has weighed on USD. With the Fed meeting next week, a hawkish surprise could support the USD and weigh on gold and silver.

As DIAMINDX is uncorrelated, the fall in the USD has not impacted its price, which has been moving lower. DIAMINDX on average over the past five years strengthens in December. Most holiday jewelry sales are made relatively last minute and December price action for DIAMINDX reflects this (chart below). According to Rapaport, US jewelers remain optimistic "as holiday sales gain momentum."

Chart: DIAMINDX seasonality in December - last 5 years and average. Price picks up in mid-December ahead of the Christmas holiday.

The Diamond Commodity

DIAMINDX was unchanged on the week, gold fell a slight 0.02%, and silver rose 1.4% on the week.

With the decline in the USD, DXY Index, which started in September, gold and silver have rallied strongly. Gold is up 10.8% from its low on September 26 and silver is up 32% from its low on September 1. Gold and silver have also benefitted from the expectation that the Fed will slow its rate hike pace, which has weighed on USD. With the Fed meeting next week, a hawkish surprise could support the USD and weigh on gold and silver.

As DIAMINDX is uncorrelated, the fall in the USD has not impacted its price, which has been moving lower. DIAMINDX on average over the past five years strengthens in December. Most holiday jewelry sales are made relatively last minute and December price action for DIAMINDX reflects this (chart below). According to Rapaport, US jewelers remain optimistic "as holiday sales gain momentum."

Chart: DIAMINDX seasonality in December - last 5 years and average. Price picks up in mid-December ahead of the Christmas holiday.

Diamond News:

The 303.10 carat

Diamond News:

The 303.10 carat